Chainalysis: Bringing Trust To Cryptocurrency Transactions

One of the prominent news items in any publication today - be it print, digital or any other form of media, is crypto currency. The sharp rise in the bitcoin and other crypto currency prices in 2017 and high volatility has made crypto currencies the darling of traders, punters and investors across the world. However, given the skepticism and negative attitude of regulatory authorities and traditional financial services participants towards this new form of currency, compliance, trust and authenticity of cryptocurrency transactions has become a prime concern for market participants around the globe.

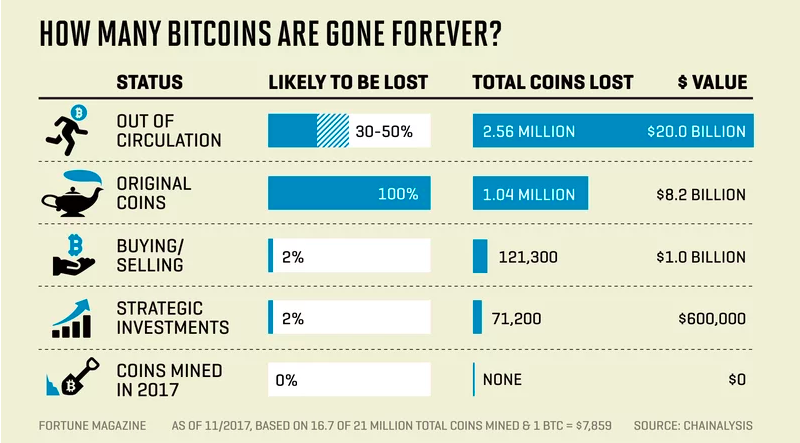

Enter Chainalysis - a blockchain based solution which is bringing trust to cryptocurrency transactions by providing the means to prevent, detect and investigate violations in cryptocurrency transactions such as money laundering, fraud and AML/KYC related violations.

Founded in 2014 and highly regarded in the crypto community, the firm recently raised $16 million in Series A financing from Benchmark to help ramp up its sales efforts and expand the number of cryptocurrencies it tracks. The Series A funding round will also see Benchmark’s Sarah Tavel, a Pinterest veteran and longtime crypto authority, join the Chainalysis board. The company has worked with both corporate clients as well as the government to track fraud and serious financial crimes pertaining to bitcoin. Federal entities that have hired the investigative blockchain firm include the FBI, IRS, SEC, DEA, ICE, and the Bureau of the Fiscal Service.

The firm has recently upgraded its capability to provide real time transaction analysis to its customers. It has also launched a new product, Chainalysis KYT that provides real-time feedback on the underlying purpose of transactions and feeds that feedback into exchanges’ transaction processing engines.

The company has competitors in the space such as Elliptic, which does similar work and has $7 million in funding. If the claims made by Chainalysis and its competitors like Elliptic about the efficacy of their solutions are true, the future seems to be bright for startups like these in the ever growing world of cryptocurrency.